You’ll need to follow the first three Rules and build the extra cushion into your budget. You won’t accomplish Rule Four overnight. That will buy you an automatic cash cushion and reduce the stress that comes with budgeting. Now, you will live on January’s income during February–meanwhile, you are saving up all your paychecks again so you can deposit Feburary’s income on March 1st.ĭoing this means your income will always be at least 30 days ahead of your expenses. Instead, you save them up and on February 1st you deposit them all at once into your checking account. Imagine that in January you don’t cash any of your paychecks. This is the hardest rule to get your head around. The basic idea is that you are always living on last month’s income. Remember at the beginning when we discussed how YNAB founder Jesse’s fourth principle was spending money that’s at least 30 days old? That principle manifested itself in Rule Four. To balance out this new budget-buster you move some money out of your grocery budget and decide to eat out of the pantry and freezer next week to get you through. It’s another rule to smooth out your expenses and keep you from abandoning your budgeting efforts completely.įor example, an old friend comes to town unexpectedly and invites you out for drinks putting you over budget in your “entertainment” category. You can address that by simply moving money from other categories into the unexpectedly higher expense category. Let’s face it, you can set up a budget, but there will be times when certain expense categories will be higher. This rule is about building flexibility into your budget. That will avoid the need to disturb your budget when it does come, or worse, to turn to a credit card.

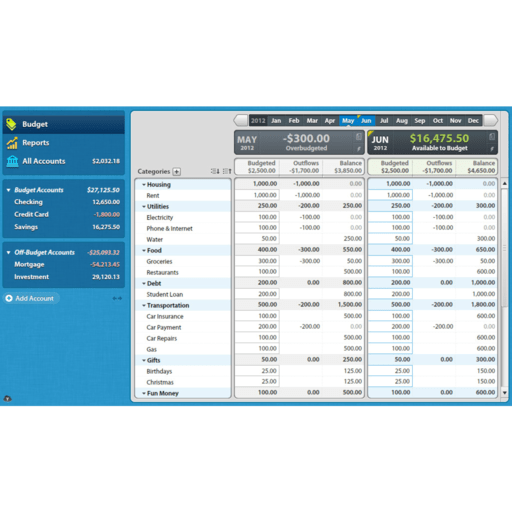

You identify the big, infrequent expenses in your budget, then set up a goal to fund them on a monthly basis.įor example, it might be something like putting away $100 per month so that you have $1,200 available when Christmas arrives. This rule is all about evening out your budget so that those large, but infrequent, expenses don’t bust your budget. You’ll know exactly how much you have for free-spending and you’ll be able to confidently move forward knowing all your goals are covered. Perhaps $500 is set aside for rent, $200 for groceries, $150 for a car payment, etc. You know exactly where that money needs to go. Before YNAB you might get carried away with the good feeling new money brings. You’ll decide in advance how money is going to be spent.įor example, let’s say you receive $2,000 on payday. The idea is to commit each dollar to a specific need, which will prevent you from spending it on an unrelated want. Simply put, you’ll prioritize how you use every dollar in your budget. The YNAB budgeting is built around four “Rules:” Rule One – Give Every Dollar a Job

#You need a budget reviews android

YNAB has received 4.1 stars out of 5 from nearly 6,000 Android users on Google Play, and 4.8 out of 5 stars from nearly 21,000 iOS users on The App Store.

#You need a budget reviews free

Not surprising, YNAB has become one of the most popular budgeting apps available (even though it’s a premium service in a large field of free providers). The company boasts the average user saves $600 by the second month, and more than $6,000 during their first year of using the app. YNAB uses a four-step process to enable you to master your money through budgeting. We’ll discuss this concept more as we move on in this review. Number four is the main pillar YNAB is built on because it, essentially, takes you from being behind your budget to being ahead of it.

0 kommentar(er)

0 kommentar(er)